It is characterized by two converging trendlines, the upper trendline and the lower trendline. To conclude, a Rising Wedge is a bearish reversal or a bearish continuation chart pattern that appears on a security’s price chart after a high momentum sustained price trend. Therefore, a Rising Wedge Pattern can either be a bearish reversal or a bearish continuation chart pattern. When that happens, the breakout still occurs in the bearish direction. That being said, on rare occasions, a Rising Wedge pattern can also appear on the price chart of a security after a prevailing downtrend. Hence, this type of wedge pattern would typically represent a bearish reversal.

This reduction in momentum is an indication that the market will turn around, and the price will fall. During the formation of this pattern, generally, the price remains in an uptrend, but its momentum gradually decreases.

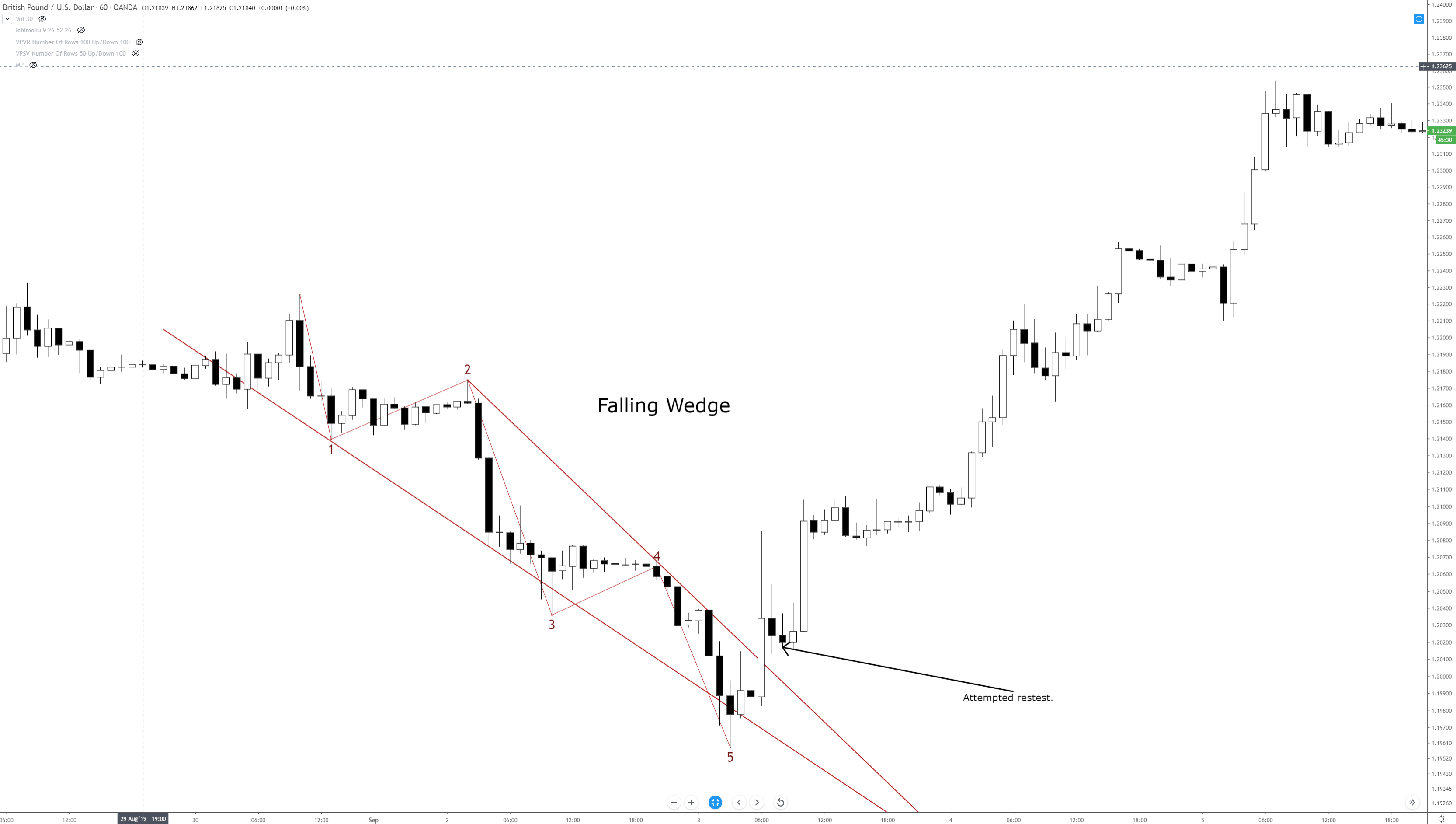

#Falling wedge series#

In this pattern, the upper trendline that maps out the series of consecutive price highs increases at a slower rate than the lower trendline as the time moves forward. Rising Wedge PatternĪs its name may have already indicated, in the Rising Wedge Pattern, the trendlines are both sloping upwards while converging at the same time. Now that we have briefly discussed the key characteristics that would generally apply to both types of the Wedge Pattern, let us discuss both variations of this pattern in some more detail.

#Falling wedge how to#

To delve deeper into the Wedge Pattern, how it works, how it can be identified, and how to use it in a trading strategy, read on. That being said, there are a few situations where the Wedge Pattern can also be used as a sign of potential trend continuation. This allows the traders to accordingly pivot their trading plan and strategies.

In most trading scenarios, the Wedge Pattern primarily indicates to traders that a reversal in the direction of the price is upcoming. Based on orientation, there are two popular types of Wedges, namely – the Rising Wedge and the Falling Wedge. In these patterns, the highs and lows of price converge to move towards each other to form a triangular-shaped structure. The Wedge Patterns, or Wedges, are chart patterns that last 10 to 50 trading sessions and that frequently appear on the price chart of a security. That being said, to the novice, trading and identifying this pattern requires some discovery first. Plus, to the eyes of an experienced pattern trader, Wedges are easy to identify and simple to trade. Wedges are considered very reliable in most trading communities and are counted among the most popular chart patterns. There are many different chart patterns that technical traders leverage in making informed trading decisions this includes the Wedge Patterns.

0 kommentar(er)

0 kommentar(er)